2021 Tech Disruption Report for IT Decision Makers

Every year we work with our partner AVANT to look at the coming year and take a pulse of how digital transformation will impact CIOs, CTOs, IT Directors and IT Managers across industries.

This report helps IT professionals make determinations based off the feedback and experience of their peers. Avant leads this research to help IT professionals answer two primary questions:

What does the imperative to transform mean to these enterprise technology decision makers?

What does the rate of change look like across industries and company sizes?

Much of the data provided in this report measures growth.

“Growth correlates to the recent usage reported by respondents as compared to their anticipated level of usage over the near term. This translates to the growth in “disruption” against legacy technologies, the identities of which vary based on the specific technology displacing the older ones. This ultimately refers to shifts in investment, focus, interest, and, ultimately, user seats and general uptake.” - AVANT

Survey Methodology and Logistics

AVANT polled 500 enterprise information technology decision-makers in the U.S. at either the C-Suite, Executive or Management/VP-level in IT, security or finance. To participate in the survey, respondents had to be the primary decision-maker in buying or implementing data, voice or infrastructure technologies for their company. Respondents work in one of five industries: Manufacturing, Financial Services, Healthcare/Medical, eCommerce and Consulting/Business Services. Let’s get into some of the highlights.

SD-WAN vs mpls

Over 60% of IT professionals surveyed, no matter the industry, intend to grow their usage of SD-WAN in 2021. 40-50% indicate they plan to “increase” SD-WAN usage while 10-20% plan to “significantly increase” SD-WAN investment by the end of 2021. This is particularly true among IT leaders at companies in the $50 million to $500 million revenue range.

44% of IT leaders who responded say they plan to “increase” their MPLS usage by the end of 2021. An additional 15% expect to “significantly increase” their MPLS investment. This is surprising since SD-WAN can replace MPLS technologies but as AVANT notes: “MPLS continues to be the technology-of-choice at the core of the network while SD-WAN is used closer to the edge.”

Cybersecurity software

No more than 50% of IT professionals who participated in the survey feel “Extremely Prepared” for a cyberattack in 2021 with their current cybersecurity framework. Not surprising, the larger the company (by revenue) the more prepared they felt with the systems and data security investment they have in place.

Unified Communications as a Service (UCaaS)

Customer interest in UCaaS surged 86% at the outset of the COVID-19 pandemic. Roughly 51% of the companies who have not moved to UCaaS cite bandwidth issues as the reason, while 36% say the learning curve is their biggest hesitation.

IaaS

Respondents from the financial and retail industries expect to have the biggest increase in infrastructure investments in 2021. 56% of the IT leaders who said they’ll stick with on-premise solutions over Infrastructure as a Service noted security concerns as their primary reason.

Colocation

According to the report, medical and consulting industry companies will be the most likely to move towards colocation services in 2021. Unlike the other technologies in this report, the likelihood of choosing colocation for data center services decreases as revenue increases. This makes sense as colocation especially helps smaller businesses lower data maintenance costs through shared equipment, space and bandwidth.

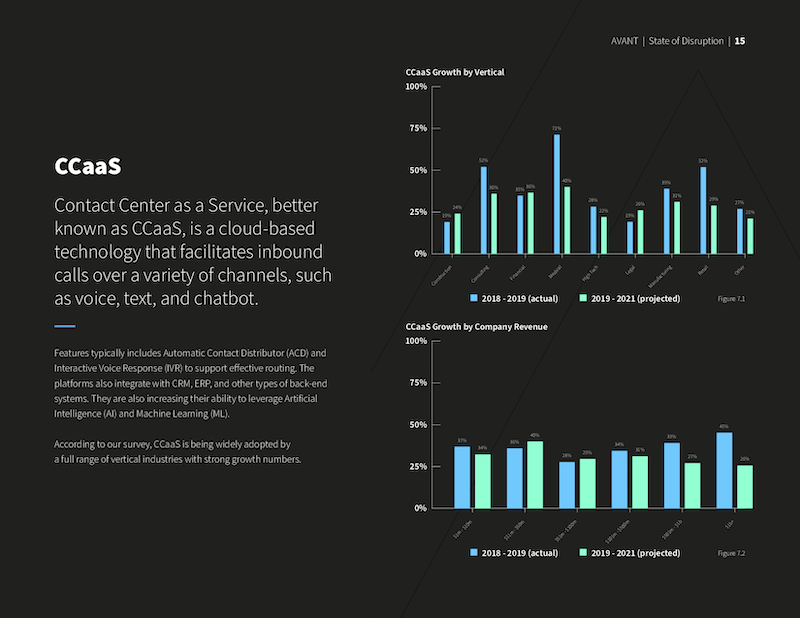

Contact Center as a Service (CCaaS)

The report shows that CCaaS adoption is being fast-tracked and we believe there are several reasons for this. In 2020, businesses rapidly moved to a work-from-home model and needed more ways to connect and communicate with internal and external contacts. Also, artificial intelligence technology features that have been added to CRM, ERP and other systems are having a very positive impact on customer satisfaction and companies are eager to implement more of those AI tools. The highest uptake and growth for CCaaS is currently in the Healthcare/Medical industries with an anticipated 40% growth in CCaaS usage in 2021.

The full report has more statistics and infographics covering Infrastructure as a Service (IaaS), Cloud Applications (SaaS), Cybersecurity, Data Security, Colocation and more. View the full AVANT 2021 Technology Disruption report here.

If you need pricing or more details on any the above technologies, let us be your trusted advisor. Our vendor agnostic approach lets you compare providers fast, efficiently, and without hassle. We help with needs analysis and provide pricing for these solutions (at no extra cost to you.) We do the research and leg work, so you don’t have to. Contact us today.

![[Webinar] Going Beyond the CISO](https://images.squarespace-cdn.com/content/v1/5ceec72c0700360001f38f8e/1654702870948-52YOAX1U82M199TJ1XEC/Copy%2Bof%2B%255BOP%255D%2BBlog%2BPost%2BThumbnail%2B%252812%2529.jpg)

![[Webinar] Cover Your ATT&CK (CYA) … Surface](https://images.squarespace-cdn.com/content/v1/5ceec72c0700360001f38f8e/1651758485782-HEYHG3MQXD6V2OK2LFWK/Cover+Your+ATT%26CK+...+Surface+Feature+Image.png)